The Digital Operational Resilience Act (DORA), effective January 2025, imposes significant cybersecurity obligations on more than 21,000 EU financial institutions. It demands robust technical safeguards, rapid incident reporting (within four hours), structured risk management, and third-party oversight. This technical guide breaks down DORA’s compliance parameters and offers actionable implementation strategies for the 2025 deadline.

Understanding the DORA Digital Operational Resilience Mandate

The Digital Operational Resilience Act constitutes a paradigmatic recalibration in EU financial sector cybersecurity governance. Diverging from conventional regulatory frameworks predicated primarily on capital adequacy, DORA establishes technological resilience as a coequal determinant of financial stability in mitigating digital disruption vectors.

What DORA Means for Financial Firms in 2025

When does DORA take effect?

Upon full implementation on 17 January 2025, DORA will impose rigorous operational resilience parameters across over 22,000 financial entities operating within EU jurisdictions.

This regulatory perimeter extends to a diverse institutional taxonomy, encompassing:

- Conventional and digital banking entities

- E-money institutions and payment service providers

- Insurance and reinsurance undertakings

- Asset management firms and credit institutions

- Private equity operations

The Role of Organisational Governance

DORA assigns unambiguous accountability to organisational governance structures—boards, executive leadership cadres, and senior management cohorts—for comprehensive ICT risk management. These governance bodies must:

- Formulate appropriate risk-management architectural frameworks.

- Facilitate implementation and supervisory oversight of strategic risk initiatives.

- Maintain current awareness regarding emergent ICT threat landscapes.

The Five Fundamental Domains of DORA Compliance

Financial entities must demonstrate verifiable competencies across these core pillars:

| Pillar | Focus Area |

| ICT Risk Management | Implementing structured methodologies to identify, protect, detect, respond to, and recover from IT-related operational disruptions. |

| Incident Management & Reporting | Developing harmonised protocols for threat classification and notification. |

| Digital Operational Resilience Testing | Executing methodical assessment regimes incorporating adversarial simulation techniques. |

| Third-Party Risk Management | Extending resilience parameters to critical service provision relationships. |

| Information Sharing | Facilitating intelligence exchange regarding threat vectors and mitigation techniques. |

Why DORA Is Different from Previous EU Regulations

DORA distinguishes itself from antecedent regulatory instruments through explicit targeting of ICT risks with prescriptive requirements governing management, reporting, testing, and third-party supervision.

Key Unprecedented Regulatory Mechanisms:

- Unified Supervisory Architecture: Ensures methodological convergence in security practices across diverse financial market participants.

- Direct Oversight of CTPPs: The first framework enabling direct oversight of Critical ICT Third Party Providers (CTPPs), including Cloud Service Providers.

- Enhanced Incident Classification: Precise requirements for the identification, response, reporting, and classification of significant ICT-related incidents.

- Threat-Led Penetration Testing (TLPT): Advanced assessment of ICT tools must occur at minimum three-year intervals.

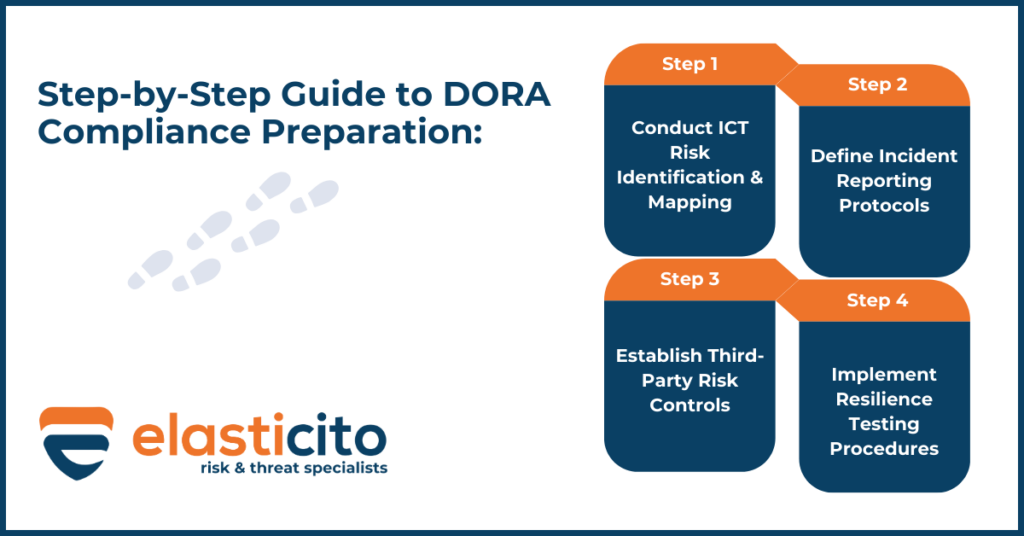

Step-by-Step Guide to DORA Compliance Preparation

Step 1: Conduct ICT Risk Identification and Mapping

Foundational DORA compliance commences with exhaustive ICT risk identification procedures. Financial entities must identify, classify, and properly document all ICT business functions, information assets, and their interdependencies.

Essential Activities:

- Inventory all information assets and ICT systems, including geographically distributed infrastructure.

- Map network resources and hardware equipment configurations.

- Audit operational processes contingent upon ICT third-party service providers.

- Flag legacy ICT systems requiring specialised risk mitigation protocols.

Step 2: Define Incident Reporting Protocols

What are the DORA incident reporting timelines? DORA establishes prescriptive chronological parameters for incident notification:

- Initial Notification: Within 4 hours after classification or 24 hours after detection.

- Intermediate Report: Within 72 hours following initial notification submission.

- Final Report: Within one month after intermediate report, incorporating comprehensive root cause analytical documentation.

Step 3: Establish Third-Party Risk Controls

Third-party risk governance constitutes a fundamental component within DORA’s regulatory architecture. Financial entities must execute thorough risk evaluations regarding ICT third-party providers, encompassing operational, concentration, and systemic risk dimensions.

- Due Diligence: Implement methodologies assessing provider alignment with institutional security frameworks.

- Contractual Provisions: Arrangements must include explicit termination rights for regulatory non-compliance.

- Register of Information: Maintain a comprehensive register documenting all ICT third-party providers, services, and criticality classifications.

- Exit Strategies: Develop validated exit strategies to maintain resilience during critical service provider unavailability.

Step 4: Implement Resilience Testing Procedures

Under DORA, financial entities must deploy diverse assessment methodologies, testing protocols, and analytical instruments.

Requisite Testing Modalities:

- Vulnerability assessments and network security evaluations.

- Architectural gap analyses and source code reviews.

- Threat-led penetration testing (TLPT) (minimum three-year intervals for critical systems).

Note: All testing activities require execution by independent parties—internal or external—possessing adequate resources and absent conflicts of interest.

Through methodical implementation of these four procedural domains, financial institutions can establish robust foundational frameworks supporting DORA compliance antecedent to the January 2025 regulatory enforcement deadline.

Conclusion

In conclusion, this guide illuminates the foundational pillars of the Digital Operational Resilience Act, underscoring its significance as a paradigm shift in EU financial sector regulation. The Act’s emphasis on proactive risk management, stringent incident reporting, robust third-party oversight, and rigorous testing mandates a fundamental reassessment of operational resilience strategies for over 21,000 financial entities.

As the January 2025 deadline looms, the imperative for comprehensive preparation is undeniable. Discover how Elasticito can empower your organisation to not only meet but exceed DORA’s demanding requirements. Stay tuned for Part 2, where we will delve deeper into advanced implementation strategies.

Created: April 30th, 2025

Reviewed:

Leave a Reply